Set Final Date For Roofing Services

With everything regarding inspections finished, all parties can now set the final date for roofing repairs and replacements. In addition, the adjuster will brief you and the roofing contractor on the payment dates and modes they will use.

Next, your roofing contractor will create a contract with you regarding the payment schedule and regularity of check or payment deposits. Indeed, the contractor will coincide its payment schedules to the insurer’s appointed issuing of checks.

Therefore, this process will be a routine for homeowners who will wait for checks to arrive, deposit them in their contractor’s account, and present proof of deposit thereafter.

When Is Hail Damaged Not Covered

While a roof may appear hail damaged, another culprit may be to blame, particularly neglect. Sunlight and harsh weather can make shingles brittle, making them appear damaged. Or the shingles may begin to blister, crack, or show signs of granule loss due to age. These types of damages are considered normal wear and tear, which insurers typically dont cover.

If hail damages an old roof that should have already been replaced, an insurance adjuster may deny a claim. However, if hail damages your roof and causes water damage inside your home, your policy may cover interior structural and contents losses.

Insurance companies usually deny claims on houses that have been vacant for more than 60 days. Some carriers may discontinue coverage of a vacant home, while others may continue limited coverage for specific perils. However, some insurers offer vacant home insurance, which may cover hail and wind damage.

You cant file a roof claim if the damage is less than your policys deductible. For example, if your policy has a $1,000 deductible, you cant file a $500 roof claim. Homes in high-risk areas may have a separate hail deductible. So if your hail damage deductible is $2,000, you can only file a claim when damages exceed $2,000.

Confirm Access To Any Roof Manufacturer And/or Installer Warranties

Depending on the age of your roof, you may still have access to manufacturing and/or installation warranties issued at the time of roof installation.

While some products may offer coverage for hail-damaged materials, it is certainly worth looking into as you may be able to find additional coverage through your existing warranties.

Don’t Miss: How Much Does It Cost To Shingle A Roof

Whats The Process Look Like For Hail Damage Roof Inspections

April 6, 2020 By Hopewell Roofing

Hail damage roof inspections should be on the top of your to-do list following a hail storm. Chances are there may be damage that is invisible to the naked eye. While you may not be able to tell, this damage can lead to additional roof problems overtime. These damages can become costlier and costlier as the months pass. Taking a proactive approach and scheduling proper hail damage roof inspections right away is your best bet to keep your roof safe and secure.

Once you make the call for hail damage roof inspections, what can you expect? Heres what you need to know about the inspection process:

Which Roofing Contractor Should I Choose

- It is your choice as to who you select and hire to provide an estimate or complete repairs to your property.

- Select an established, licensed, or bonded roofer. .

- Get references as well as certificates of insurance , and verify they are active when your work is scheduled.

- Ask your claim handler if your claim is eligible for the State Farm Premier Service Program and the Roofing Services Program. If eligible, your claim handler can explain the details of the Roofing Services Program and determine if the program is available in your area.

- You may refer to the Contractor Locator page on statefarm.com® to see contact information for Roofing Network Service Providers listed. You may contact any roofing network service provider whose information appears on the Contractor Locator page to get details and additional information regarding services they provide or to get assistance with identifying and selecting participating contractor within their network who service the customers geographic area who may be available to complete roofing repairs to your property.Note: State Farm does not warrant or guarantee the performance of any Roofing Network Service Provider or contractors you select.

Also Check: Skylight For Metal Roof

What Size Hail Causes Roof Damage

On average, it takes a 1″ or above diameter hail stone to cause damage to common asphalt shingles. When referring to hail sizes, here are a few common objects to compare:

- Pea = 1/4-inch in diameter

- Dime or penny = 3/4-inch in diameter

- Nickel = 7/8-inch

- Golf Ball = 1½ inches

- Tennis Ball = 2½ inches

- Baseball = 2¾ inches

Read Your Terms And Conditions

To know the explicit details of your hail damage roof insurance claim benefits, read through the fine print of your policy.

Insurers will write in full detail the insurance policy’s provisions and benefits for homeowners. When reading, look for “triggers”, which phrases such as “the policy is activated when A causes extensive roof damage requiring professional help” or something similar indicate.

If your insurer tells you they cannot honor your stated benefit yet your policy terms and conditions indicate it is part of the coverage, then you can contest it to maximize your claim benefits.

Don’t Miss: Corrugated Roofing Overhang

What If The Adjuster And Contractor Disagree On The Damage

This isnt uncommon and it doesnt necessarily mean your claim will be denied, says Teece. If the insurance adjuster and contractor arent in agreement on the cause or level of damage, the homeowner should request that they speak to one another and try to reach alignment. In some cases, they may reach a consensus that satisfies everyone.

If the contractor and adjuster cannot reach consensus, Teece said, the homeowner can request a second opinion from a new adjuster.

How Do Roof Insurance Claims Work

Filing a roof insurance claim involves several steps. Our expert team at Scros Roofing uses more than two decades of industry experience handling the paperwork, inspections and communication needed for a fast turnaround time. To save you from property losses beyond your control, your homeowners insurance company will pay for your roof replacement.

Before making a claim, Scros Roofing ensures all storm damages are documented. We will visit your home to conduct an in-person assessment and use drones to develop a 3D model of your property for the insurance provider. Below are the steps to take if you believe you may have a roof insurance claim:

Don’t Miss: Skylight On Metal Roof

What Is The Hail Damage Insurance Claim Time Limit Within Which You Can File A Request

The time window for filing a hail damage insurance claim depends on your insurance policy. In most standard policies, the period within which you can file a claim is one year. Youll have a year to determine whether your car or home has any damages caused by a hail storm.

Keep in mind that you should report the damage as quickly as possible after you notice it because youll have a hard time proving your case if too much time passes.

Hail Damage To Roof Vents And Shingles

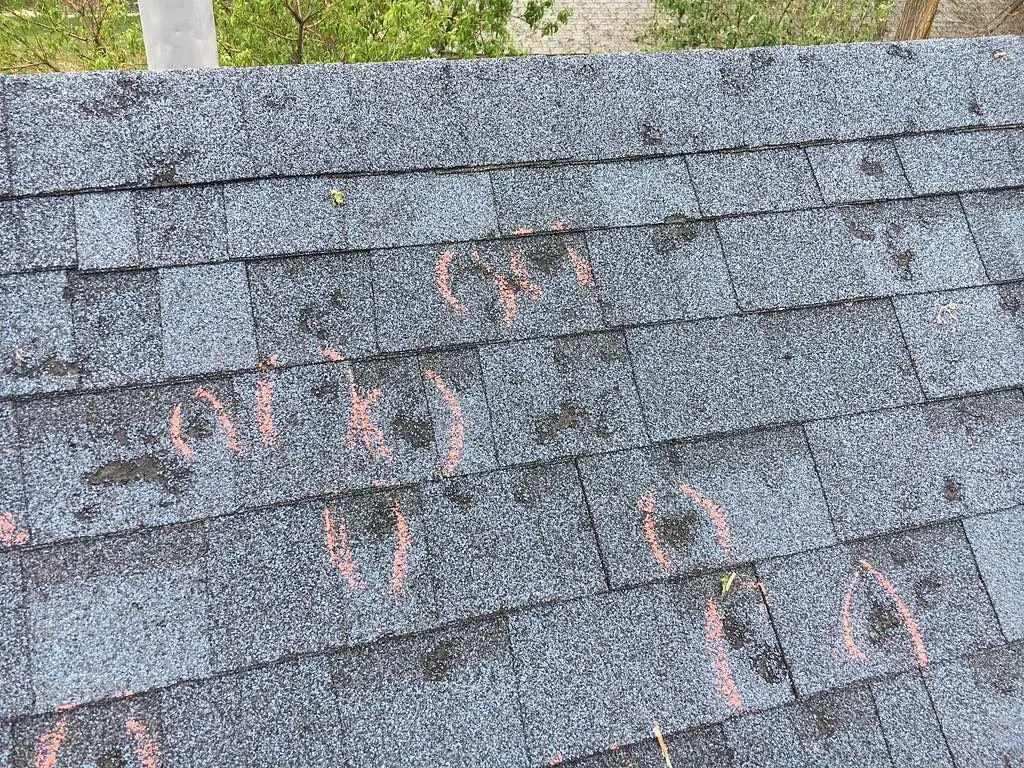

Once you’re up on the roof, there’s going to be a few things to look for. Vents, chimneys, sky lights, other features and shingles are on our inspection list.

Hail damage often accompanies wind damage to roofing systems, so you’ll want to look for both.

Check out all the roof vents and features to look for any damage. Look for dents, dings, chipped surfaces, etc.

For the harder to see impact areas like the chimney covers , run your chalk sideways over the surface and it will uncover the hail impact points. For the softer metal vents, the damage will be much more obvious.

The last, but most important thing to check is the shingles. Hail damage to roof shingles are what buys the roof. You’ll never get a solid insurance claim without shingle damage.

Don’t Miss: Cost Of New Roof California

Notify Your Insurance Company

If there is damage that needs to be repaired, the next step is to actually make the claim. Its a good idea to make the claim as soon as possible. Hail can cause roof leaks that, if left unrepaired, can cause devastating damage to the inside of your home. If your air conditioner was damaged and even if its in usable condition, continued use may damage it more or mean that it needs to be replaced entirely. Other damage can get worse over time and cause more damage elsewhere to your property if its not addressed promptly.

Your insurance company will not pay for damage caused by a delay in repair. They would only pay what they have determined is the value of the actual damage caused by what your policy covers, within the limits of your policy and after any deductibles.

Can You Claim Hail Damage Twice

Yes. But there are some things to keep in mind before you make this decision. You can file as many claims as you need, but the more claims that are filed means the higher your premiums will be. One claim won’t typically affect your rates but two claims in a row may cause an increase in your premium.

Recommended Reading: Shed With Overhang Roof

Leaks After A Hail Storm

After being struck by hail, many homeowners are unaware that their roofs might leak. When the ice pellets embed themselves in your roofing material till they melt and harm the delicate materials below, this happens. Get in touch with a roofing company right away if youre having leaks and storm damage on your roof due to hail the longer you wait, the more water can get into your house and the more damage it may do. A hail-damaged roof is typically an emergency and you cannot wait to get it fixed.

Why Would Only Part Of My Roof Be Repaired

Because storm damage can be concentrated and spotty, its possible that your insurance company would cover the replacement of one part of your roof, but not the entire thing. If the slope of the roof was hit hard by the storm but the rest of your roof doesnt show any damage, your insurance company may repair only the damaged slope, said Teece.

There is one primary exception to this, and that occurs if the roofer cannot find shingles to match your current roof in color, size or material. If your roof is unique and matching shingles arent available, you may receive approval for the entire house to be re-roofed, said Teece.

Recommended Reading: Rv Rubber Roof Repair Kit

Colossal Mistakes Homeowners Make With Insurance Claims

The average Texas homeowner pays $3,429 in annual home insurance premiums, but only makes a claim once every 9 years. Thats $30,861 in premiums over that span!

As a policy holder you have a contract with your insurance company. When you experience legitimate damage to your property, it is your contractual right as a policy holder to make a claim and get paid in full for your loss. After all, that’s what you have insurance for in the first place.

But all too often, mistakes are made by homeowners in the process of making a claim – mistakes that unnecessarily cost them thousands of dollars.

We hope this guide will help you avoid the 6 most common mistakes we see homeowners make during an insurance claim.

Mistake #1 – Not Filing a Valid Claim

Most people have insurance policies to protect themselves should something go wrong, then when something does, theyre afraid to use it!

That sounds crazy at first. You have insurance. Something went wrong. Why not use it?

The fear is that by making a claim, rates will go up or you will be cancelled. That is possible if you make a high-risk claim or if you have too many claims for incidents that are within your control , but not for naturally occurring incidents like a roof insurance claim. For more info, check out our blog What Causes Insurance Premiums to go Up?

The downloadable guide is FREE and contains “Insider Secrets” not found on the website…

Tips: What To Do If You Get Roof Damage

Protect the home from further damage. If a tornado rips through your neighborhood and tears part of your roof off, protect your home from further damage. In fact, preventing further damage when possible is often a requirement in homeowners policies, and further damage may not be covered. You may need to put up a tarp while you alert your insurer.

Dont let the insurance company boss you around. Insurance companies are a business and may not have your best interests in mind when it comes to paying out roof damage claims. If youre not doing a good job of explaining what they should be paying you, they have no fiduciary obligation.

Youre entitled to fair trade pricing, so make sure you have a solid repair estimate. If you have a large or complicated claim, consider hiring a public adjuster to work on your behalf.

Dont get multiple estimates. If you get multiple estimates, your insurance company will want to see all of them and may only accept the lowest one. The lowest estimate may not be the best quality.

Consider roof material that can get you an insurance discount. Research materials that will be more durable than your past roof. Your insurance company might be willing to offer a discount for impact-resistant roofing. Check with the insurer on roof material discounts before you make a final pick.

Also Check: How To Extend A Roof

Official Claims Require A Professional Inspection

Insurance adjusters depend on professional roofing contractors to determine the cause of the damage before a claim could be approved. Not all hail damage is easily noticeable by untrained eyes. Small hail can remove the granules on asphalt shingles prematurely and cause indentations that novices wouldnt detect as threats to your roof. However, a trained roofer can spot the signs of hail damage right away. The best time to check is right after a storm so that your inspector can make a clear connection between the type of damage theyre seeing and the recent storm.

Why Is Hail Bad For Your Roof

Hailstorms can cause significant damage. Most times, wind and hail damage to a roof can be repaired without a full roof replacement or total home repair. If hail has damaged your roof, its best to contact an expert for an independent assessment before you decide to file a hail damage claim with your insurance company.

You May Like: Cost To Install Trusses

Have A Professional Roofer Inspect The Roof For Hail Damage

A quality roofer will give you an honest assessment of whether you have a reasonable claim to file. If the hail damage is minimal, you should NOT file a claim, keeping a claim off your record. Most insurance companies base your rates off of the number of claims you have filed. Click for information on how to hire a professional roofer.

Review Your Homeowners Insurance Policy

Its best to know what your home insurance policy does and doesnt cover before you need to file a claim. When a hailstorm strikes, review the fine print of your policys coverages and exclusions. Coverages A and B cover losses to your homes main structure and attached structureslike a garageand coverage C covers personal property such as furniture and clothing.

Also Check: How Do I Know If My Roof Is Leaking

When To Call In A Professional Contractor For Your Hail Damaged Roof

If you arent sure if your roof needs repair work or you arent comfortable performing the repairs yourself, thats when its time to call in a professional contractor and talk to your public adjuster about getting it covered.

You may also want to consider your insurance coverage and how the policy is worded regarding fixes that you may perform yourself as an amateur versus repairs done by an official professional.

Know that a professional contractor will have their own liability insurance in case anything goes wrong as well, so errors you make may be harder to get covered or more complicated to fix in the future.

And if you have any questions about the process of fixing your damaged roof after a hail storm or other weather event, you should call your public adjuster they are your best advocate and can help you navigate the tricky areas of not only dealing with a hail damaged roof, but help to ensure that the repairs or replacement roof and any associated damage is covered by insurance if and when applicable.

How To Claim Hail Damage On A Roof In Ontario

In this article, you will learn: 1. Does Home Insurance Cover Hail Damage? 2. How to Claim Hail Damage on a Roof in Ontario

Ontario weather patterns are often unpredictable, and when hail strikes it can wreak havoc on your residential roof.

With speeds of up to 100 km/h and sizes ranging from small pebbles to large golf balls even the smallest of hailstorms can cause some serious damage within a short amount of time.

Unfortunately, many Canadian homeowners are unfamiliar with the process of filing a home insurance claim causing a great deal of anxiety on top of an already stressful situation.

From photos and documentation to repairs and receipts, its helpful to understand the process ahead of time to ensure that you are fully reimbursed for any covered roof repairs.

As dealing with roof damage is already challenging enough, we at T. Simpson Roofing Ltd have put together the following article to help you approach your next insurance claim with confidence.

Don’t Miss: Metal Roof Extension