What Are Capital Improvements

Essentially, capital improvements are improvements made to a property that increases the value of the asset. In this scenario, it could be something like converting the attic into an en suite bedroom or the garage into a separate apartment.

If something is replaced, even if the original is irreparable, this counts as a capital improvement. For example, the roof has a leak and it is deemed necessary to replace the whole roof, this would be a capital improvement.

When determining whether a maintenance job is a capital improvement or a repair, ask yourself does it add value to the property beyond that of its original value? or does it simply return value to the property?

Recommended Reading: Add Overhang To Shed

When Repairs Become Improvements: A Gray Area

The difference between a capital improvement and a repair sounds clear in theory but can get complicated in practice. Imagine a one-off repair turns into a full-fledged renovation. Which part of that expense counts as a capital improvement? Some? All? None?

To navigate this gray area, the IRS uses a facts and circumstances analysis to determine whether a project is considered a capital improvement. The IRS is always going to be looking at the situation as a whole, Wasserman explains. It depends on the specific facts in that circumstance.

The IRS will promote a repair to a capital improvement in three ways, each of which must provide a permanent improvement on the value or the life of the property, Wasserman says.

These include:

- A betterment, such as adding on a room or curing a defect: In one example from the IRS, if you live in an area prone to earthquakes and install expansion bolts to anchor a building frame to its foundation, thats a betterment. It provides structural support.

- A restoration: such as any costs to restore a property to its original state after a loss or damages, such as a fire.

- An adaptation i.e., any cost of converting a property to a different use: If you remodel a residence to use it as a rental, thats an adaptation. Likewise, if you install a wheelchair ramp or wider doorways or renovate the bathroom to accommodate a disability those are adaptations and capital improvements.

How To Know If Your Roofing Job Is A Capital Improvement

April 8, 2019 by Amy Andrews

When you get a job done in a commercial or rental property, youve no doubt wondered if it will count as a capital improvement. After all, capital improvements can be deducted from your taxes. This is especially the case when you know the job done on your home increases its value. There is one way to tell if your home improvement project counts as a capital improvement and thats through the BRA Test.

In this post, State Roofing discusses all you need to know about the BRA Test.

The BRA Test

In order for your repair and maintenance project to be deducted from your taxes, you must first have it capitalized. Especially when the repair and maintenance make the property better or allows it to adapt to a new use. The BRA Test is one way to determine this.

Betterments

These are the repairs that make an aspect or function of your home better, hence the name. This includes repairs of a pre-existing defect before the property was bought, such as hiring a to fix a damaged roof. Others include defects during the construction of the property, property expansion, increasing the propertys quality, strength, and efficiency.

Restorations

Restorations are when you have something restored to its normal condition, such as replacing an entire roof. Repairs under this category include restoring deteriorating property, rebuilding the property to pristine condition, and restoring a substantial part of the property.

Adaptations

Exceptions

You May Like: Does My Home Warranty Cover Roof Leaks

Benefits Of Maintenance Improvements

There are several benefits to investing in maintenance improvements:

- Preventative maintenance can keep small problems from becoming big ones.

- They can improve the appearance of your property.

- They can help you avoid more future operating costs down the road.

- A super or general maintenance person can handle maintenance without needing a specialist.

- They are immediately tax-deductible

There are a few potential drawbacks to maintenance expenses:

- They may not increase your property value as much as a major capital improvement.

- They may not make your property attractive to potential buyers or tenants.

- It may not get to the root of a repair problem, as general maintenance is simply a bandaid.

When Should I Do Repairs Or Improvements

The best time to do repairs or improvements is when it is most convenient for you. However, you should remember that some regular maintenance may need to be done to avoid further damage to your property. For example, if you have a hole in your roof, youll want to repair it as soon as possible to avoid water damage to your property.

You May Like: How To Find Roofing Jobs

When In Doubt Ask A Pro

Still fuzzy on whether a project on your mind is a capital improvement or a repair? Tell your real estate agent or a tax professional what youre considering. Even if your project doesnt count as a capital improvement, it might be worth doing to preserve your property value and keep the house in great shape for whenever youre ready to sell.

Header Image Source:

Is Roof Replacement A Capital Improvement

4/5capital improvementReplaceroofcapital improvementreplacement

Simply so, what is the difference between a repair and a capital improvement?

The IRS makes a distinction between capital improvements and repairs. However, repairs that are part of a larger project, such as replacing all of a homes windows, do qualify as capital improvements. Renovations that are necessary to keep a home in good condition are not included if they do not add value to the asset.

Furthermore, what counts as capital improvements? The IRS defines a capital improvement as a home improvement that adds market value to the home, prolongs its useful life or adapts it to new uses. Minor repairs and maintenance jobs like changing door locks, repairing a leak or fixing a broken window do not qualify as capital improvements.

One may also ask, is a new roof capital or expense?

Maintenance jobs can turn into capital improvements.While a roof repair would have been considered a maintenance expense, the necessary roof replacement has just become a capital expenditure.

Is replacing a door a capital improvement?

Adding a part to replace a broken one in an HVAC unit would be a repair. Putting a new unit in for a second floor or newly enclosed garage would be a capital improvement. Adding a screen door might not be a capital improvement but adding a ramp and ADA compliant entrance door would be.

Recommended Reading: How Much Is Plywood For Roofing

What Is The Capital Gains Tax Exemption

The capital gains tax typically applies whenever you sell an asset for more than its original purchase price. The IRS offers a tax exemption from the capital gains tax when your primary home resale matches certain specifications.

When you increase your cost basis, you can also reduce your capital gains tax. Thats because you calculate your gain after you subtract the new cost basis from the profit of selling your home. Since the gain is smaller, the applied taxes are as well.

Can I Expense A New Roof On Rental Property 2022 Irs Rules

Owning a rental unit opens the door to income opportunities and offers the ability to grow wealth over the long term. But real estate can also leave you with a significant number of tax liabilities, especially when you overlook valuable tax deductions.

It might be straightforward to deal with costs like property management and real estate commissions. But what happens when you have significant repairs?

Luckily, the Internal Revenue Service allows rental property owners to expense costs incurred in improving the property to help lower their rental income tax liability. Such improvement costs include adding rooms, landscaping improvements, and other expenses like roofing.

Well help you understand how the expenses for a new roof qualify as allowable deductions and how you can expense the amount.

Key takeaways

- Rental property experiences wear and tear, requiring investors to make repairs and improvements to keep a home safe and habitable for a tenant.

- Repair costs can be expensed the year the expenditure is incurred, while improvements are added to the property cost basis and depreciated over an extended period of time.

- The cost of a new roof on a rental property is expensed by depreciating the improvement cost over 27.5 years.

Read Also: How Much To Replace Roof Flashing

It Increases The Value Of Your Home

If you are considering a home renovation, think carefully about the costs involved. Adding a new roof does not necessarily increase the value of your home in every market. The value of any home renovation depends on the general conditions of the housing market. To be sure, talk to experts in your area to get an idea of the current market conditions in your area. Asking for their opinion will help you determine whether a new roof will increase the value of your home.

Is A New Roof A Repair Or Improvement

- Post published:February 16, 2022

- Post category:Investments

If you are trying to determine whether a new roof is considered a repair or an improvement for tax purposes, then you are in the right place. There is a difference between the two, and it is important to understand them before investing. We did the research on the subject to bring you the answer.

Replacing an entire roof with a new one is considered an improvement. The improvement must be capitalized and depreciated. The difference is that a repair is considered maintenance, such as patching roof leaks or replacing shingles.

As a homeowner, it is important to know the difference between a repair and a capital improvement for tax purposes. This article will take a closer look at why a roof is considered a capital improvement on your home. In addition, we will discuss other frequently asked tax questions about replacing a roof on your home, so keep reading!

Also Check: Can You Get A New Roof In The Winter

How Much Work Was Done

Take note of the minor and significant repairs done on the roof. What parts were replaced and why? Generally, replacement of parts isnt considered a significant portion of the roof and doesnt qualify as capitalization standards. For tax purposes, repairs over 40% of the roof surface are subject to capitalization.

Are Roofing Repair Costs Currently Deductible It Depends

Are roofing repair costs currently deductible? For tax professionals, this question comes up frequently when we have discussions with clients regarding the tax deductibility of repairs and maintenance costs incurred in their business. What do you mean I have to capitalize and depreciate over 27.5 years or 39 years for tax purposes is often a stern response we get when addressing this question. The good news with good recordkeeping and an overall understanding of what was done, we can sometimes provide our client a current tax deduction for these costs. This discussion will focus on roofing repair costs.

Replacing a substantial portion of any major component of a building meets the definition of a capital improvement. A roofing system is considered a major component because it performs a critical function to the operation of the overall building. The list below is not considered an all-inclusive list under the regulations for tax deductibility but is provided for general guidance to help develop conversations between you and your advisors to help determine the tax treatment of the costs incurred. Before a decision is made on the deductibility of the items below, a complete evaluation of your specific fact pattern must be considered.

Ryan D. Gorman, CPA

Dont Miss: Adding Gable Overhang To Existing Roof

Recommended Reading: What Is The Best Color For Roof

Is A New Roof An Asset

A new roof is considered a capital improvement and, therefore, subject to its own depreciation. For example, if youve owned a rental property for 10 years before you installed a new roof, you can depreciate the roof over 27.5 years, even though you have 17 years of depreciation left on the property.

Making Repairs Vs Capital Improvements

Its essential to distinguish between repairs and capital improvements, as theres a fine line of difference. Obviously, painting, wallpapering and redecorating dont count as capital improvements, but what about substantial repairs to a house? Generally, the answer is no, as the IRS doesnt consider work that restores something to its original condition as a capital improvement, no matter how extensive. However, there are exceptions. Fixing a leaky roof is not a capital improvement if it consists of just replacing a few shingles. Replace the entire roof, and it is a capital improvement, as replacement is not restoration. The same holds true if the repair is a structural improvement, such as replacing the foundation so the house wont collapse.

Those who live in a house are likely to make capital improvements over time, whether intentionally or not. You intentionally make a capital improvement when you add a bathroom or finish your basement. You may unintentionally make a capital improvement when you replace your broken water heater or faulty furnace because you need these fixtures to work to remain in your home. Fix the water heater or furnace and it isnt a capital improvement. A good rule of thumb to determine the difference between repair and capital improvement: if its considered maintenance its not a capital improvement.

You May Like: How To Figure Shingles For A Gable Roof

How Can I Correctly Classify My Roofing Project As An Improvement Or Repair

If a sudden storm came in and damaged the roof and youre looking to fix the sudden damage, generally this is not making the asset better its restoring the original value, so this is not going to qualify as a capital improvement if you are going to use the same materials.

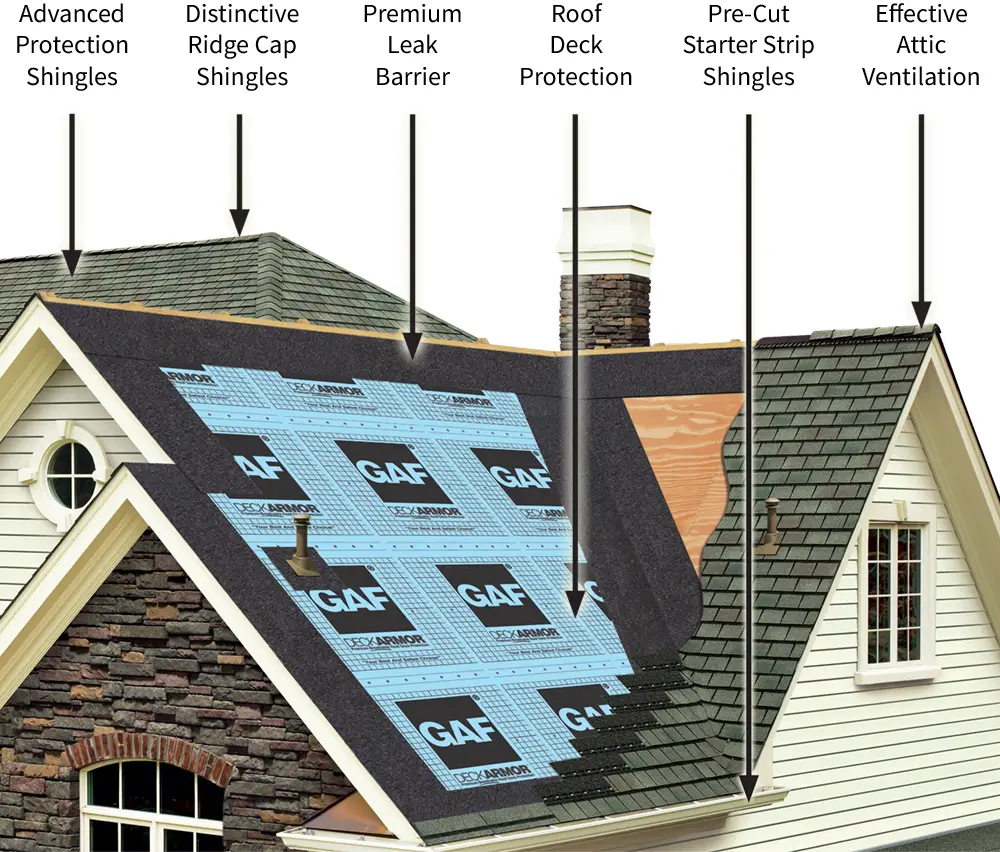

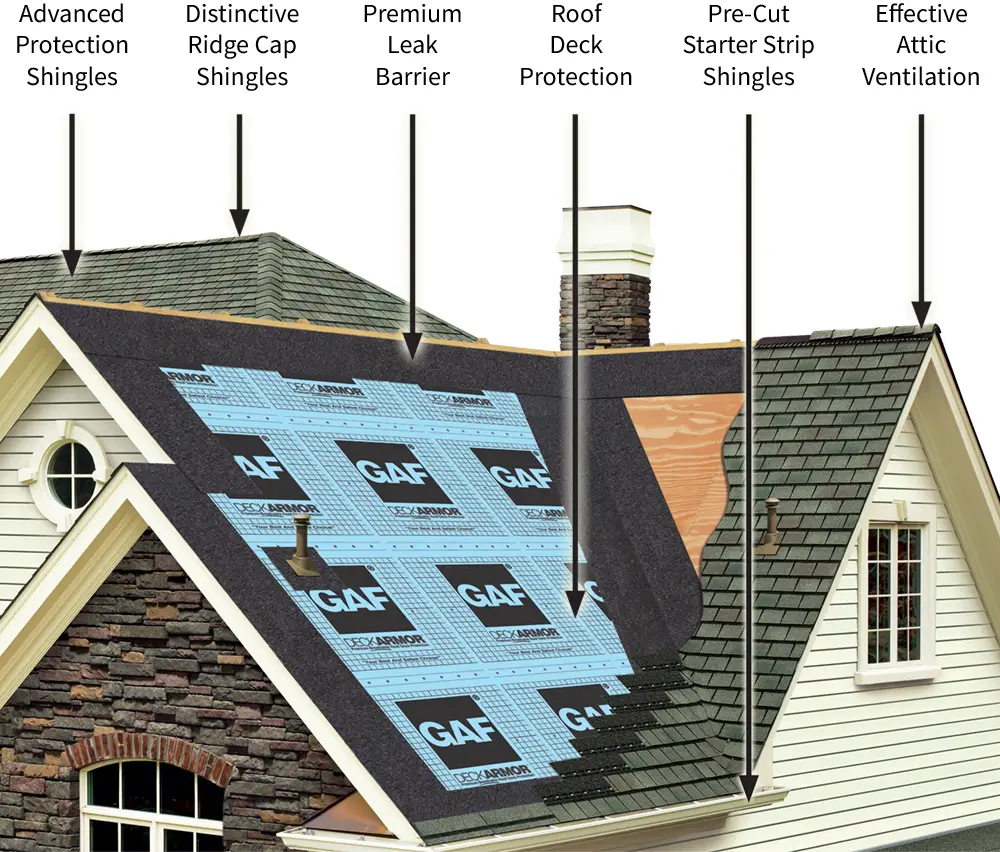

You can more obviously improve the original value by changing grade of materials , but you can also improve on the original value by enhancing the grade of material beyond the original value. A great example of this would be going from standard grade shingles to GAF architectural shingles.

2.) How long has it been between the purchase of the property and when work was done on the roof?

In many cases, if you have to do significant work on your roof and its been within about two years of you buying the property, the work can qualify as betterment because youre correcting defects or pre-existing conditions. If its been a significant amount of time, e.g. 5+ years since you bought the property, then generally betterment wont apply.

3) What was the roof material before?

If you use materials that significantly improve the life span compared to the original roof, then you can generally claim it as betterment. For example, a shift from standard asphalt shingles that last 20 years to slate tiles that last 50+ years is a betterment because youve increased the quality of the building.

4) Did you get the roofing job done because the building was expanded ?

What Is Considered A Capital Improvement In Property Management

Related

A capital improvement does not refer to an increase in a businesss monetary position. Capital improvements are physical repairs, conversions, upgrades or additions made to a property that increase its value over time.

Capital improvements increase your balance sheet value, and they must also be treated properly by your accountant and tax preparer, depending on how you want to pay for them. Understanding what capital improvements are and how to address them with your financial reporting will help you get the most out of your buildings, land, equipment, rental units or other properties.

Also Check: How Many Screws Per Square For Metal Roofing

Don’t Miss: What Is The Best Cleaner For Roof Shingles

Other Tax Breaks Exist Too

Real estate agents like Eric Forney, a listing specialist in Indianapolis, Indiana, always ask sellers about significant renovations and repairs, as well as the ages of their homes major components and appliances. That way, he has this information for buyers and can guide sellers toward any possible tax savings.

For instance, a Residential Energy Property Credit allows taxpayers to claim a credit for 10% of energy-efficiency improvements such as insulation, exterior windows, and certain roofing products, or up to $500 for expenditures such as energy-efficient heating and air conditioning systems.

How Do People Finance Capital Home Improvements

One popular example is cash-out refinances, which is a type of mortgage refinancing that uses the amount of equity youve built up in your home. In essence, you borrow more on your original mortgage and accept the difference as cash which you can use on improvements. You then pay off the original first followed by the second mortgage they dont stack together as monthly payments.

Another option is a home equity line of credit . This method also uses your homes equity to help finance your capital improvement. Here, you borrow money against built-up equity, but instead of receiving cash like the cash-out refinance, you receive a line of credit. Rocket Mortgage® does not offer HELOCs.

Both choices let you free up some money for certain expenses, including renovations, repairs or other home improvements.

Need extra cash for home improvement?

Use your home equity for a cash-out refinance.

You May Like: How Much Do Louvered Roofs Cost